Product Benchmarking: How to Do It Right to Improve Your Product Performance

They say comparison is the thief of joy. Well, if you do your product benchmarking wrong, that’s definitely true. Now, there’s nothing wrong with seeing how you measure up against competitors. In fact, that can give you a LOT of amazing insight to learn about where you can improve and make your product thrive. It’s a core aspect of continuous improvement.

The challenge is that product benchmarking is actually pretty hard to do. You may think that’s silly to say as it’s a pretty straightforward concept: compare how you’re doing to those around you. But in practice, there are loads of factors that can make your benchmarking subpar.

We’re going to take a look at the common product benchmarking mistakes that PMs are often falling into and give you some helpful tips on how to avoid them so that your product benchmarking is actually useful and informative. For product-led growth companies, this analysis and measurement is the fuel to help you find areas for improvement so you can drive growth, but only if you’re benchmarking the right way.

Let’s explore all the issues you could be falling foul of, and what to do to make your product benchmarking as effective as possible.

What is product benchmarking?

Product benchmarking is the practice of comparing your various product metrics against a set of standards to judge how well your product is performing. These standards are goals that you’ll want to at least match, and ideally exceed. Product benchmarking allows you to assess your product’s performance relative to industry norms.

A lot of the time, product benchmarking involves analyzing your product against your competitors, seeing how you shape up against others in your industry. You can also benchmark against industry norms, which are the average performance metrics that you can expect an everyday company in your industry to achieve.

Benchmarking helps you assess your product’s strengths and weaknesses and lets you see how you’re getting on compared to the rest of the field. It’s like comparing your grades to everyone else in your class. If the class average is a C+ and you’re getting an A, that means you’re one of the star pupils. Great.

The goal of product benchmarking is to find gaps and uncover opportunities to make sure your product stays competitive. Benchmarking is not a one-and-done task, it’s an ongoing process that allows you to make data-driven decisions about every aspect of your product, like product pricing strategies, the features you offer, and more.

The two types of product benchmarking

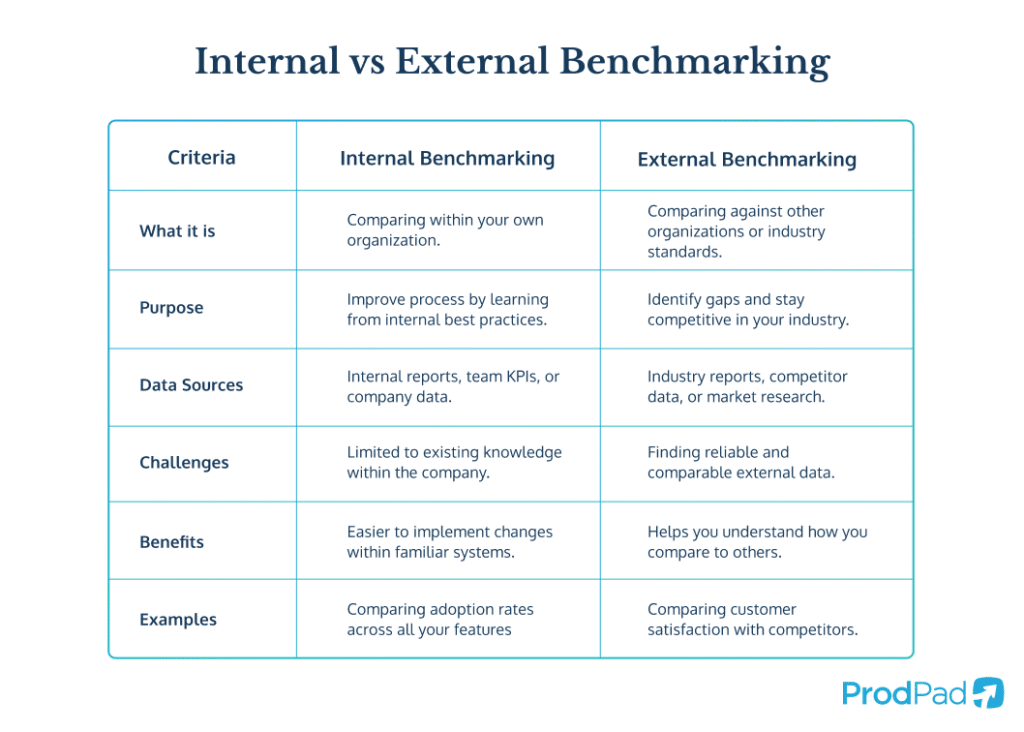

There are two main types of product benchmarking, internal and external.

- Internal benchmarking: Focuses on comparing your performance and outcomes against yourself, seeing how things have changed over a period of time. By comparing performance against yourself, you’ll be able to see what initiatives have worked and what needs to change to improve performance.

- External benchmarking: This involves analyzing your product against competitors or a set of industry standards. This is where you find out how you stack up against the real world. This is useful when you want to assess your product positioning and find areas where competitors have the edge.

Ideally, you’ll be using both types of product benchmarking to get a better sense of how you’re doing relative to your industry and to yourself. Focusing on your own product performance helps keep you grounded too. You always want to be a little bit better than yesterday.

What are the benefits of product benchmarking?

Product benchmarking is something you definitely should be doing as a Product Manager. There’s a whole range of benefits waiting for you each time you analyze your performance against industry or internal benchmarks. When you benchmark properly, here are some of the things you’ll be able to do:

Prioritize with precision

Benchmarking helps you focus on what truly matters by revealing where your product excels and where it stinks. It can confirm areas where you’re already leading the pack or highlight hidden opportunities for improvement. For instance, if your conversion rates are already stellar, you can shift attention to other areas like retention or scalability.

Uncover market trends and stay relevant

Regular benchmarking keeps you informed about market shifts and emerging trends. This helps you adapt your product to meet changing customer expectations, adopt new ideas that are gaining traction, and avoid clinging to outdated features that no longer serve your audience.

Foster continuous improvement

Benchmarking provides actionable insights to improve not only your product but also your processes. Whether it’s optimizing workflows or refining features, this data-driven approach supports ongoing innovation.

Enable data-backed decision-making

With insights from benchmarking, you can confidently prioritize updates, allocate resources, and plan roadmaps based on facts, not hunches. This facilitates data-driven Product Management which allows you to reduce the risk of investing in features or strategies that don’t deliver ROI.

Set realistic goals

Aiming for the sky is admirable, but set your target too high and you’re just going to end up disappointed. Benchmarking gives you a sense of what’s achievable by showing you where top performers are in your market. This helps set practical yet ambitious goals for your product and team.

What metrics should you measure when product benchmarking?

When benchmarking your product, the metrics you focus on will typically differ depending on your industry and the type of product you have. For example, a B2B SaaS tool will want to focus on different metrics than an entertainment platform.

That said, some metrics are just more important than others and will be ones that you’ll want to measure and compare against regardless of the industry you’re in. We’ve broken down the most common metrics to benchmark and explain why they matter and why everyone looks at them.

1. Activation rate

Activation rate measures the percentage of users who complete a key action that signifies they’ve experienced your product’s core value proposition. Known as user activation, this is often the first major hurdle in the user journey. A strong activation rate indicates that your onboarding process and initial value delivery are working as intended.

By comparing your activation rate to that of competitors, you can evaluate whether your entry-point experience meets industry expectations and pinpoint areas for improvement if your rate lags behind.

2. Product stickiness

Product stickiness refers to how often users engage with your product, typically measured by the ratio of Daily Active Users (DAU) to Monthly Active Users (MAU). A sticky product is one that users find indispensable, making it a critical indicator of long-term engagement and user retention.

Benchmarking your product’s stickiness against competitors allows you to gauge whether users are engaging with your product on a regular basis, signaling that your product is meeting their day-to-day needs. If your stickiness is lower than competitors, it might point to areas where your product is failing to capture frequent usage or ongoing user interest.

3. Feature adoption rate

Feature adoption rate tracks the percentage of users who regularly use a specific feature out of the total number of active users. This metric helps you understand how well individual features resonate with your user base. When benchmarking feature adoption, comparing your rates to others in your space can highlight features that are underutilized and suggest opportunities to improve those features, making them more valuable and appealing.

If a particular feature has low adoption compared to industry standards, it could indicate usability issues or a lack of user education around its benefits, which you can address by creating a killer product tour to improve overall engagement.

4. Net Promoter Score (NPS)

Net Promoter Score (NPS) measures customer loyalty and satisfaction by asking users how likely they are to recommend your product to others on a scale of 0 to 10. This score gives a broad picture of your product’s reputation and overall customer sentiment.

A high NPS compared to industry benchmarks can suggest that users are highly satisfied and willing to advocate for your product. On the other hand, a low score signals areas for improvement.

By benchmarking your NPS against the average standard in your industry, you can gain insights into where your product stands in terms of user loyalty and identify specific areas to focus on for boosting customer satisfaction.

5. Customer churn rate

Customer churn rate refers to the percentage of customers who stop using your product within a specific time frame. High churn is often a warning sign that your product may not be meeting users’ needs or that there are issues with user retention.

By comparing your churn rate to benchmarks, you can determine whether your retention efforts are on par with industry standards. If your churn rate is higher than average, it might suggest a need for improvements in user engagement, product-market fit, or customer support to keep users satisfied and reduce turnover.

6. Pirate Metrics (AARRR Framework)

The Pirate Metrics framework, encompassing Acquisition, Activation, Retention, Referral, and Revenue (AARRR), provides a comprehensive view of your product’s performance throughout the entire user lifecycle. Benchmarking each stage of the AARRR funnel helps you identify strengths and weaknesses across your product’s journey.

For instance, if your retention rate is lower than the benchmark, it might suggest that your users aren’t finding lasting value or engagement in your product. Understanding how each of these stages stacks up against the rest of the industry helps you focus on areas with the greatest impact on your overall performance, guiding you toward optimizing your product for long-term success.

While the above metrics are common benchmarks, the specifics will shift based on your industry:

- B2B SaaS: Should also focus on metrics like free-to-paid conversion rates, customer lifetime value (CLTV), and time-to-value. These reflect the subscription-based nature of the model and the importance of long-term customer relationships.

- B2C Products: Metrics like DAU, MAU, and user engagement are more critical, as these products typically rely on high-volume, frequent interactions to thrive.

- E-commerce: Metrics such as average order value, cart abandonment rate, and purchase frequency come into play.

By customizing your benchmarking efforts to your industry and target audience, you can ensure you’re tracking the metrics that matter most, providing insights that directly support your product strategy.

So you know what to measure, but what are the benchmarks you’re looking to beat? Well, Mind The Product has a pretty interesting benchmarking tool that gives details on the overall performance of these metrics for various industries. It’s worth checking out.

Common product benchmarking mistakes you might be making

Alright, here’s the juicy bit. There are a lot of things at play that mean that you may not be getting the most out of your product benchmarking.

Have you ever done your product benchmarking and felt like crying because everything pales in comparison? Have you ever done your benchmarking, seen where you’re lagging behind, but have no idea how to improve it? If these are common experiences for you when undertaking product benchmarking, the good news is that we’re going to help set you straight and turn this comparison exercise into something truly valuable for you.

If product benchmarking isn’t doing it for you right now, here’s where you may be going wrong:

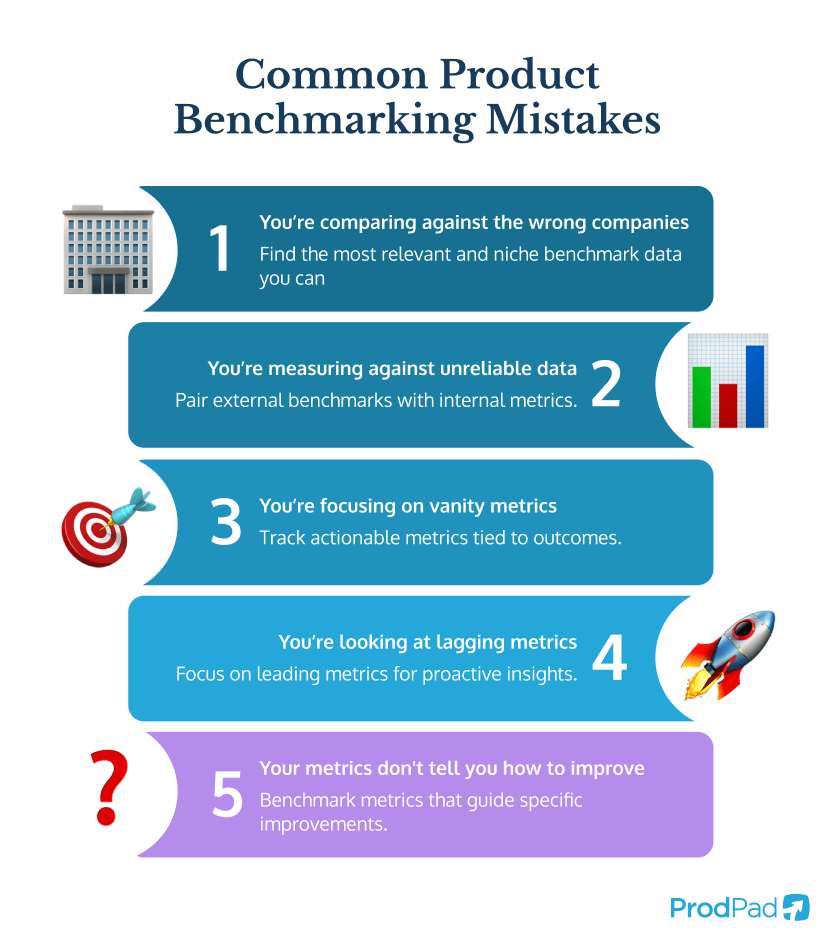

You’re comparing against the wrong benchmarks

You need to find the most relevant benchmarks you can to get the most useful comparison. Don’t base your assessment on extremely broad benchmarks that haven’t drilled down into your niche. It’s important to do your research and try to find the most granular data you can. If your product is a B2B SaaS tool, don’t settle for benchmarks for all ‘digital products’.

If your product is an e-commerce platform and you want to assess your ‘time on page’ performance (for example), don’t base your comparison on a general benchmark, look for specific e-commerce website benchmarks.

Otherwise, you run the risk of unfairly comparing your performance against products that will always have a stronger performance in some areas than you. For example, if you are managing an e-commerce site as your product, you don’t want to be assessing your performance based on benchmarks for, say, returning traffic, which also include tools like email platforms. People are in their emails every day – you can’t compete with that! And nor should you. You need to be looking at benchmarks for returning traffic that are specific to the e-commerce industry.

You’ll also hit issues if you’re trying to conduct your product benchmarking against specific products rather than general industry data. And that’s because it’s only the super mega-successful companies that are openly sharing their performance metrics!

It’s a lot easier to gather information from the likes of Google, Slack, and Dropbox, as they are proud of what they’ve achieved and want to boast. These companies often share eye-popping metrics that seem like the gold standard. But here’s the issue: their performance isn’t typical – it’s exceptional. These companies operate on a scale, budget, and level of maturity that most businesses can’t match.

The issue here is that measuring up against these companies means that you end up comparing yourself against the top 1%. Setting your product benchmarking against ultra-successful companies leads to unrealistic expectations. It’s like comparing your weekend jog to an Olympian marathon runner – it sets you up for disappointment and skews your understanding of where you really stand.

It’s fine to aspire to these performance results and try and learn from these companies that are killing it, but it’s not fair to assess your performance against them right now.

The fix: Use benchmarks relevant to your industry and based on aggregate data across the broad spectrum of products in the space.

It’s like boxing, a Heavyweight can’t fight a Featherweight as it’s an unfair matchup. This “weight class” approach ensures the comparison is fair and actionable. You’ll gain insights that are actually relevant to your business.

You’re measuring against unreliable data

So you want to benchmark against competitors, but that creates another issue. Unlike big players that often flaunt their success, most companies keep their performance metrics close to their chest. I imagine you’re not posting every minute detail about your Q3 performance, so don’t expect your competitors to do the same.

This means that you have to rely on industry reports that provide an average across a specific market – that’s what benchmarks are after all. Although useful, you need to be mindful that this only provides a snapshot, and may not be as nuanced as you’d ideally like. Plus, these reports are usually released annually, meaning that you end up benchmarking against outdated statistics.

All this can lead you to draw wrong conclusions about your product performance.

The fix: Combine external benchmarks with internal data. If you’re struggling to establish a baseline, draw on your own performance metrics to establish what you need to do and where you need to be going. This can help you supplement the industry benchmarks you may already know.

You’re focusing on vanity metrics

Some metrics are great for stoking your ego but don’t really tell you the true health and performance of your product. They may look impressive at first, but may not give you any actionable insights to help you improve things.

For example, having a huge number of overall app downloads might look cool, but it means nothing if your activation and retention rate is abysmal. By skimming this surface-level insight, you risk ignoring more useful metrics about your product’s actual performance.

The fix: Shift your attention from vanity metrics to actionable metrics tied to product outcomes. Things like activation and feature adoption give you more of a clue on whether users find your product valuable. With these detailed metrics as part of your product benchmarking, you’ll know what you need to focus on to improve.

You’re looking at lagging metrics

Product benchmarking metrics can either look backward or point forward. Metrics like churn rate or revenue often reflect outcomes from decisions made weeks or months ago. While important, they’re backward-looking indicators that tell you what happened, not what’s happening now or what’s likely to happen in the future.

Lagging metrics don’t give you the foresight to make proactive changes. By the time you identify a problem, the damage might already be done. For example, noticing a spike in churn after months of decline means you’re reacting to a crisis instead of preventing it.

The fix: Focus on leading metrics when product benchmarking. These are statistics that by improving them, you’re sure to drive growth. metrics such as activation rate, feature engagement, or product stickiness, provide early signals of potential success or failure. Use these to stay ahead of problems and respond to trends before they snowball into larger issues.

Your product benchmarking metrics don’t tell you how to improve

All metrics paint a picture and let you know how you’re performing, but when benchmarking your product, you want to isolate metrics that give you insight into where you need to improve. For example, say you’re benchmarking ARR and see that you’re pretty far behind the industry standard. It’s useful to know that you’re behind, but now you’ll be scratching your head trying to figure out why.

It’s like comparing your 100m sprint time to 2024 Olympic Champion Noah Lyles. You can see that your time of 15s (we’re being generous here) against his 9.78s is worse, but why? This metric doesn’t tell where to improve. Is it because he’s got a longer stride? A quicker reaction time off the blocks? Has better lung capacity? You just don’t know where to start to make the biggest improvements. This could lead to you focusing on improving something that gives you marginal gains.

Say you find out that your reaction time off the block is actually comparable to Noah’s, but it’s your stride length that’s letting you down. You’ll get bigger gains by focusing on what’s worse. This is the same thing you need to do with your product – look at metrics that shine a light on the best areas to improve so that you can allocate resources well and efficiently to improve performance.

The fix: Every metric you track in product benchmarking should have a clear purpose, and make it clear what aspect of your product you need to work on. Tracking monthly recurring revenue tells you nothing – but tracking your Customer Retention Rate tells you whether users are sticking around long enough to generate that revenue, and this can give a better indication of what you must do to improve it.

So, how do you measure up?

Not getting the most out of your product benchmarking? Well, hopefully with this overview and advice on how to fix common mistakes, you’ll be able to compare better and see how you match up. Benchmarking is more than just seeing how you’re doing against others; the focus should be on learning where you should look to improve to make gains and stay competitive.

Product benchmarking is a tool to drive product growth and to make you more successful, so be sure to utilize these tips to take your product benchmarking to the next level.

And if you’re keen to improve your entire Product Management process, why not give ProdPad a try? Our tools help PMs implement best practices into their everyday workflow, helping you to manage roadmaps, tie customer feedback to ideas, and a hell of a lot more. Plus, we’re benchmarking pretty well against other Product Management tools 😉.

But don’t just take our word for it word for it, why not see for yourself. Schedule a demo with one of our product experts and see what ProdPad can do for you.

See ProdPad in action.