Product Analysis: How to Assess a Product

Product analysis is a major part of Product Management. As a Product Manager, you need to know how to assess a product to evaluate what’s working and what’s not – whether that’s your own product or a competitor’s product. That involves reviewing its strengths, weaknesses, alignment to customer needs, market position – the whole shebang.

Whether you’re a recent hire and want to take stock of what you’re working with, or are trying to discover ways to re-ignite a product that’s lost steam, product analysis is going to help you.

Let’s walk hand-in-hand through product analysis, covering what it is, how you do it, plus many other things.

Here’s a table of contents so that you can jump around:

Product analysis:

What is product analysis?

Product analysis is the process of evaluating a product using both quantitative and qualitative research to answer strategic questions. It helps teams uncover what’s working, what’s not, and why. By digging into data, customer feedback, and user behavior, product analysis provides clarity on trends, pain points, and opportunities – turning raw insights into actionable decisions.

At its core, product analysis is about getting to the ‘why’ behind the numbers and behaviors.

There are a lot of ways to do product analysis, which we’ll cover later, but most of the time it involves systematically assessing how a product is used, where it excels, and where it can be improved.

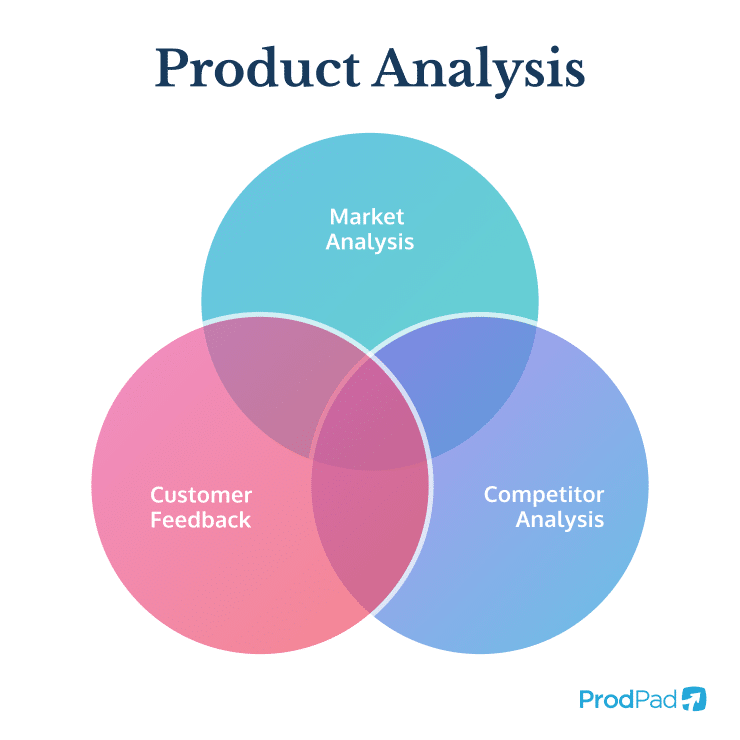

Three key parts of product analysis

Product analysis has three main components. These are:

- Market analysis: Understanding industry trends, consumer behavior, and product positioning and perception to ensure your product stays relevant and competitive.

- Competitor analysis: Knowing what your rivals are up to helps you find gaps, refine your positioning, and stay ahead of the game.

- Customer feedback & insights: Listening to your users to hear what’s working, what’s frustrating, and what they actually want from your product.

Think of these three things as the primary colors of product analysis. They set the base foundation, but there are still a lot more colors and analysis methods to use – we’ll dive deeper into those later.

Why do product analysis?

Regularly analyzing a product isn’t just a nice thing to do from time to time – it’s essential for building and maintaining a successful product. Here’s why:

- Smarter decision-making: Product Teams have to weigh up constant trade-offs. Conducting research-based analysis and analyzing real data ensures choices are driven by facts rather than assumptions, reducing risk and uncertainty.

- Improved user experience: By learning about potential issues and frustrations from a user perspective, product analysis helps create a smoother, more enjoyable experience that keeps customers engaged.

- Competitive advantage: The market moves fast, and competitors are always improving. Analyzing trends and customer needs ensures a product stays relevant and ahead of the curve.

- Better prioritization: Not all feedback or issues carry the same weight. Product analysis highlights which changes will have the most significant impact, helping teams focus their time and resources on the right things.

- Sustained growth: A product that doesn’t evolve stagnates like a pond. Ongoing analysis ensures a product continues to meet business objectives and customer expectations over time.

Product analysis vs competitive product analysis

You can run product analysis on any product. So that could be the product you are responsible for, or a competitor product (or any product in between).

Obviously, when conducting product analysis on your own product, you have access to more information – like usage data, customer feedback, revenue numbers – and with competitive product analysis you’ll have to use slightly different approaches, but the principles are the same. You’re assessing the strengths and weaknesses of a product.

There is crossover here though. Analysis of your own product should always include a degree of competitive product analysis so you understand how your product stacks up against competitors and what position it holds in the market.

In a nutshell, the difference between product analysis and competitor product analysis is about the direction you’re looking at when conducting your research:

- Product analysis focuses on assessing your own product’s strengths, weaknesses, and opportunities for improvement. It’s an introspective look that helps teams refine features, fix issues, and better serve users.

- Competitive product analysis (also called competitive analysis) looks outward, examining competing products to understand their features, positioning, and market strategies. This helps identify gaps, differentiate offerings, and stay ahead in the market.

Check out our full guide on competitor product analysis to learn more:

What are the different types of product analysis?

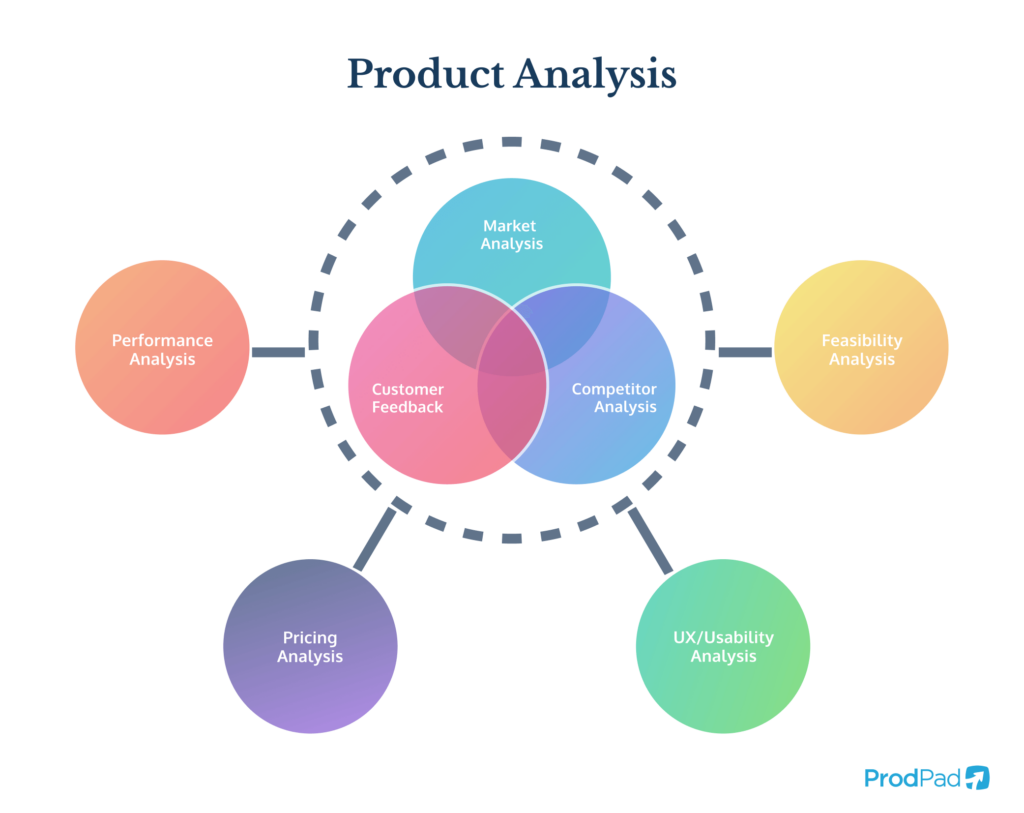

So far we’ve discussed product analysis in its broadest sense. But product analysis is kind of like a Russian doll, hiding other analysis methods within it. It’s now time to open the doll up and see what else nestles within product analysis.

The truth is that there are a lot of different ways to conduct product analysis. Product analysis is a combination of various research and evaluation techniques. Here are some of the most common types that expand on the core three:

- Customer research 🧑💻 – Get inside your users’ heads by exploring their behaviors, pain points, and needs through surveys, interviews, and behavioral tracking.

- Market research 📊 – Analyze industry trends, market size, and customer demand to make sure your product has a strong, competitive position.

- Competitor research 🏆 – Study competing products to find market gaps, opportunities, and ways to stand out.

- Performance analysis 📈 – Track key metrics like user engagement, retention, and conversion rates to measure success and optimize growth.

- Pricing analysis 💰 – Dive into pricing strategies, customer willingness to pay, and market positioning to fine-tune your revenue model.

- UX/usability analysis 🎯 – Test how users interact with your product to identify friction points and improve the overall experience.

- Feasibility analysis ⚙️ – Determine whether a product or feature is viable from a technical, financial, and operational standpoint before diving in.

Each of these areas includes multiple methods of analysis, allowing teams to uncover insights that shape their product strategy. Let’s take a look at some of the common methods for product analysis:

Customer research

Customer research focuses on understanding your customers’ perceptions and experiences with your product. This qualitative approach provides insights into customer needs, preferences, and areas for improvement. Effective methods include:

- Surveys: Structured questionnaires that can be built in-app that gather quantitative and qualitative data on customer satisfaction, preferences, and expectations.

- Interviews: In-depth, one-on-one discussions that explore individual customer experiences, uncovering detailed insights into their interactions with your product.

- Customer Advisory Board (CAB) Meetings: Regular meetings with a selected group of customers who provide strategic feedback and guidance on product development and improvements.

- Net promoter score (NPS): A metric that measures customer loyalty by asking how likely they are to recommend your product to others, providing an indicator of overall satisfaction.

All of this revolves around the customer feedback loop. To get the best feedback, you need to train your Customer Support Teams on how to gather it all properly. Luckily we have you covered. Check out the guide which comes with a downloadable presentation deck for you to use with your Customer Teams.

How to Train Customer Teams to Get Really Useful Feedback

Market research

Market research involves analyzing external factors that influence your product’s success, such as market trends, customer segments, and competitors. Key methods include:

- User personas: Creating detailed profiles representing different segments of your target audience to better understand their needs and tailor your product accordingly.

- Market validation: Assessing the demand for your product or feature through techniques like surveys, interviews, or crowdfunding campaigns to ensure it meets market needs.

- Prototyping and beta testing: Releasing a pre-launch, MVP version of your product to a limited audience to assess market reaction, demand, and identify potential improvements.

Competitor research

Competitor research is all about analyzing competitor products, strategies, and market positions to identify opportunities and threats, informing your product development and positioning.

A couple of ways to learn about your competitors include:

- Strategic canvas: Scoring each competitor based on a specific value element like price, performance, usability, etc. With these scores, you can see where your product excels compared to your competitors, and find opportunities to improve.

- Product benchmarking: Comparing your product’s performance, features, and processes against industry standards or competitors to identify best practices and areas for enhancement.

Performance analysis

Performance analysis is where your product analytics comes in, focusing on quantitative data to assess how well your product is performing. This involves tracking user behavior and measuring key metrics to help you understand how successfully your product is being adopted and engaged with, informing data-driven decisions.

When looking at your product analytics, track important performance metrics like:

- Adoption rate: The percentage of new users adopting your product over a specific period, indicating market acceptance and growth.

- Monthly active users (MAU): The number of unique users engaging with your product monthly, reflecting user retention and engagement.

- Customer churn rate: The percentage of users who stop using your product over a given timeframe, highlighting potential issues with satisfaction or value.

- User retention: The ability of your product to retain users over time, indicating long-term satisfaction and loyalty.

That’s of course only a handful of metrics you can track. We’ve got a full list of Product KPIs to help you identify the right ones for you.

In addition to capturing product usage data and tracking metrics, you can uncover more about your product’s performance by conducting analysis methodologies like cohort analysis.

Here you can assess the impact of any changes you make to the product by comparing groups of users over time – for example, comparing the users who used the product or feature before the change was implemented versus those who used the product afterwards.

A quick note on tools for product analysis

You’re going to need the right tools to ensure you have the product analytics you need to conduct performance product analysis. We’ve got a list of the best product analytics tools you can check out:

Pricing analysis:

Pricing analysis is all about seeing how the way you structure your product pricing impacts sales and customer perception.

Here are some ways to analyze your pricing strategy:

- Demand elasticity: Analyzing how changes in price affect the quantity demanded, helping to optimize pricing for revenue and market share.

- Van Westendorp price sensitivity: A survey-based technique that identifies acceptable price ranges by asking customers about their price perceptions.

- Gabor-Granger pricing method: A technique that determines the optimal price point by assessing customers’ willingness to pay at different price levels.

You can learn more about all three of these methods in our price testing article:

Product Price Testing: How to Know When the Price is Right

UX analysis:

User experience (UX) analysis examines how users interact with your product to identify usability issues and enhance overall satisfaction. Methods include:

- Session replays: Recording and reviewing user interactions to observe behaviors, identify pain points, and improve interface design.

- User journey mapping: Visualizing the steps users take to achieve their goals with your product, highlighting opportunities to streamline processes and enhance experience.

- A/B Testing: Comparing two versions of a product feature to determine which performs better, enabling data-driven design decisions.

- HEART Framework: A set of metrics – Happiness, Engagement, Adoption, Retention, and Task Success – used to evaluate user experience and guide improvements.

Feasibility analysis:

Feasibility analysis is a type of product analysis that you do when you’ve got an idea for a new feature or update. Here, you’re checking to see if the proposed idea is something that can actually be done on a technical level.

One major way to do this is to look at and review your product architecture to see if your proposal fits in with your current system. Other analysis methods include:

- Assess technological requirements and resources: Determining the technical needs and resources necessary for development to ensure alignment with your organization’s capabilities.

- Review technical debt: Identifying existing technical debt that could impact the development or performance of the new feature, ensuring sustainable progress.

Who does product analysis?

Product analysis is a cross-functional task involving various teams to ensure you get a holistic view of your product’s performance. The following people chip in:

- Product Managers: You will lead the analysis and make decisions based on the data.

- Data Analysts: They help with deep data analysis, especially when dealing with large datasets and complex models.

- UX/UI Designers: Work to understand user behavior and identify usability issues.

- Marketing Teams: Can provide insights into how the product is being received, what else is happening in the market, and help assess engagement metrics.

- Developers: Provide technical feedback on product performance and how data is captured.

When do you perform product analysis?

You’ll be diving into product analysis at various stages throughout your product lifecycle – whether you’re gathering feedback on a new feature, fine-tuning an existing one, or taking a step back to assess your overall product strategy. That said, there are key moments when product analysis is essential to keep things on track:

Product analysis when launching a new product or company

When you’re just starting out, whether as a new startup or introducing a new product, understanding where your offering fits in the market is crucial. This means you need to focus on market research to assess industry trends, competitor positioning, and demand. Customer research is also key to identifying pain points and user stories to validate your product.

The focus at this stage is on exploratory and qualitative analysis to refine the product before growth. If you’re working at a startup, check out our glossary that covers what you need to do as a Startup Product Manager.

Product analysis when in the Growth Phase

As your product gains traction, the goal shifts to optimizing and scaling. The growth phase is all about refining your product-market fit and identifying areas ripe for expansion. During this stage, product analytics plays a vital role in helping you track performance, user adoption, and engagement.

Tracking these metrics reveals what drives user retention and uncovers areas of friction. Understanding where users are finding value and where they’re experiencing challenges will help you maintain momentum and fuel product-led growth.

Product analysis in the ongoing Product Management lifecycle

There are a few other stages in the Product Management lifecycle where product analysis becomes important

- Post-launch 🚀: After releasing a feature, it’s time to track performance and see if it’s delivering as expected. This is when you check if your assumptions hold true and whether users are engaging as planned.

- Feature optimization ⚙️: When user feedback starts rolling in, it’s time to refine your features. You’ll want to optimize based on what’s working, what’s frustrating, and what needs more polish.

- User experience (UX) improvements 🎯: UX analysis is crucial for pinpointing pain points in the user journey. Are there bottlenecks or friction that are preventing users from reaching their goals smoothly? Addressing these will help you create a seamless experience.

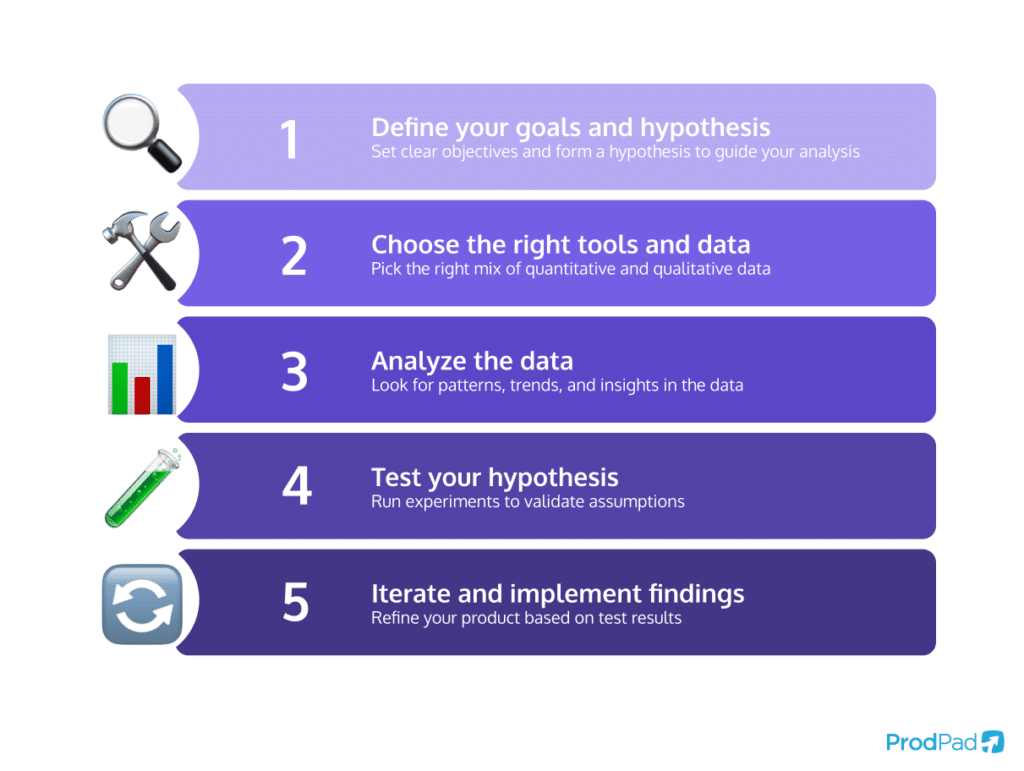

How do you do product analysis well?

To do product analysis well, you’re going to want to follow a clear, step-by-step framework. Now, all product analysis looks different, depending on the techniques you use or the particular analysis you’re focusing on, but this guide below is built to allow you to plug in your chosen method and get to work.

Product analysis step-by-step guide

Step 1: Define your goals and hypothesis

Before diving into the data, clearly define your objectives. What are you hoping to learn? Once your goal is clear, develop a hypothesis around what you expect the data to reveal.

For instance, you might hypothesize that adjusting your pricing model will increase acquisition. This hypothesis will act as the lens through which you review the findings of your product analysis, so it’s crucial to get it right.

Step 2: Choose the right tools and data

Next, it’s time to decide on the tools you’ll use and the types of data you need to collect. You’ll want a mix of both quantitative (like user behavior or feature usage) and qualitative data (like feedback from users or satisfaction surveys). Depending on your objectives, different tools are going to be needed.

With your tools, you might need to track specific types of data, such as:

- Behavioral data: Tracks user interactions, like clicks, session lengths, and drop-offs.

- Customer feedback: Qualitative insights from surveys, reviews, and user testing to gauge satisfaction and identify pain points.

- Feature adoption: Understanding how users are adopting and interacting with new features can shed light on areas for improvement.

- Market data: Understanding the competitive landscape, consumer perception, trends, expectations, and more.

Step 3: Analyze the data

Once you’ve gathered the data, dig into the patterns, trends, and behaviors that emerge. This stage is not just about confirming your hypothesis but uncovering new insights. Examine the trends in what you found – are there patterns?

Start asking the tough questions: What’s driving these trends? If they’re bad, what can you do to stop them?

Step 4: Test your hypothesis

Now it’s time to validate your assumptions through small experiments. This ensures you’re not making major changes based on guesses.

Start with incremental tests. For example, if you think your product analysis will reveal that your pricing model isn’t right and you think a pricing change will boost sign-ups, try it on a small user segment first and measure the impact. A/B testing is a powerful tool here. By testing two variations of a feature or design, you can directly compare which one performs better under real-world conditions.

Step 5: Iterate and implement findings

After testing, it’s time to iterate. Refine your product based on what worked and what didn’t. Then get ready to do it all over again!

The key to realizing the benefits of effective product analysis is continuous improvement – you’re never really “done.” Even after a successful iteration, new rounds of testing or user feedback may reveal additional opportunities for refinement. Product analysis is an ongoing cycle, where each round builds upon the last, allowing you to keep adapting and improving your product.

Product analysis challenges and best practices

Product analysis isn’t easy. Here’s our list of things to watch out for that can impact your product analysis, and the best practices you can follow to combat them.

🛟 Drowning in data: With endless dashboards, reports, and spreadsheets, it’s easy to get buried under a mountain of numbers.

– The fix: set clear objectives and focus on the metrics that actually drive decisions, not just the ones that look impressive in a meeting.

🧠 Navigating biases: Data might be objective, but humans? Not so much. Confirmation bias can lead teams to cherry-pick stats that support their existing beliefs.

– The fix: bring in diverse perspectives from your cross-functional teams, run peer reviews, and question assumptions before making big calls.

👤 Losing sight of the user: If your product isn’t built for users, all the analysis in the world won’t fix it.

– The fix: Prioritize user-centricity by regularly testing usability, running surveys, and feedback loops to ensure that customer needs drive decision-making – not just internal hunches.

🏗️ Working in silos: If teams aren’t sharing insights, they’re making decisions in the dark.

– The fix: Cross-functional collaboration to ensure that data isn’t just hoarded by one team but is used collectively to paint a full picture of product performance.

🐢 Stagnation from inaction: Insights aren’t worth much if they’re just sitting in a report.

– The fix: Turn learnings into action, iterate on what works, and foster a culture where continuous improvement is the norm – not a one-off project.

⚖️ Juggling competing priorities: When everything is urgent, nothing actually gets done.

– The fix: Product teams need to define and defend their focus, using clear goals and strategic prioritization to cut through the noise and drive meaningful impact. Keep it simple and focus on what matters to avoid analysis paralysis.

Product analysis explained

Product analysis makes up a huge part of Product Management. It helps you learn about your product, discover ways to make it better, and improve the value proposition for your customers.

This article should give you everything you need to know to perform product analysis yourself and discover potential possibilities with your product.

Once you’ve completed product analysis, and validated the potential solutions and hypotheses created from it, you need a place to track your progress on these efforts. You need a product roadmap.

In ProdPad you can track all your experiments, manage your process through discovery all the way to measure results and monitor the impact on your OKRs, and all centered around a Now-Next-Later roadmap that includes a view of ‘completed’ initiatives as a permanent record of your product changes and the impact they drove.

Give ProdPad a try for free today and see how the tool helps you effectively manage your ongoing product analysis and use it to make informed decisions.

Try ProdPad for free today